October 2015

This month’s newsletter takes a look at how SPC can be used to help determine which supplier to select to use in the long term. The process starts with collecting baseline data on the existing supplier and then running tests using the potential supplier’s product. A control chart is used to compare the two suppliers. And then you have to do some calculations to determine the financial impact to your company.

The example in this publication involves saw blade life. One metric that be used to monitor saw blade life is called the G-ratio. This metric is used to compare two suppliers.

In this issue:

- Introduction

- G-Ratio

- Supplier A Baseline G-Ratio Data

- Supplier B G-Ratio Data

- Comparing the Cost of Supplier A to Supplier B

- Continued Monitoring

- Summary

- Quick Links

You may download of pdf copy of this publication here. Please feel free to leave a comment at the end of this publication.

Introduction

What is your approach to compare Supplier A and Supplier B? Test out a few of the new saw blades from Supplier B and see if your operators think they perform better? That might work, but then again, it is not too data-based. You could measure how long a saw blade lasts from Supplier A and compare that to a saw blade from Supplier B. That is getting closer.

What you need in any analysis like this is a metric that allows you to compare the performance of the suppliers. A useful metric for saw blade life is the G-ratio. This is a measure how much material a blade can cut over its lifetime. The G-ratio calculation is explained below.

G-Ratio

Area = πR2= π(0.9)2= 2.545

Let k = number of cuts a saw blade makes. This saw blade makes 150 cuts. The total bar area cut is then given by:

Total Area Cut = k(πR2) = 150(2.545) = 381.75

To calculate the G-ratio, we still need the area of the saw blade consumed during cutting. The starting OD of the saw blade is 26 inches. After 150 cuts, the saw blade OD is 20.10 inches. The saw blade area used is given by:

Starting Area – Ending Area = π(26/2)2– π(20.10/2)2= 213.62

The G-Ratio is given by:

G-Ratio = Total Bar Area Cut/(Saw Blade Area Consumed) = 381.75/213.62 = 1.787

This value can be used to compare saw blade performance over time. The higher the G-ratio, the more bar area a saw blade can cut.

Supplier A Baseline G-Ratio Data

The operators collect the data for you over thirty samples. There are no problems with the data collection. The operators do a great job of remembering to enter the data and do so accurately. Happens all the time, right? Well, hopefully most of the time.

The data collected by the operators are given in the table below.

Table 1: Supplier A Baseline G-Ratio Data

| Saw Blade No. | G-Ratio | Saw Blade No. | G-Ratio | |

| 1 | 1.15 | 16 | 1.03 | |

| 2 | 1.12 | 17 | 0.99 | |

| 3 | 0.93 | 18 | 1.32 | |

| 4 | 1.12 | 19 | 1.38 | |

| 5 | 1.18 | 20 | 1.26 | |

| 6 | 1.19 | 21 | 1.06 | |

| 7 | 0.90 | 22 | 1.05 | |

| 8 | 1.26 | 23 | 1.03 | |

| 9 | 1.32 | 24 | 1.15 | |

| 10 | 1.30 | 25 | 1.19 | |

| 11 | 1.17 | 26 | 0.90 | |

| 12 | 0.89 | 27 | 1.07 | |

| 13 | 1.35 | 28 | 1.01 | |

| 14 | 1.10 | 29 | 0.97 | |

| 15 | 0.88 | 30 | 0.92 |

The average of these thirty samples is 1.106. Do you now just test Supplier B’s test saw blades and compare averages? You could do that, but you might be missing a very important point – and that is statistical control. Is the process that generated the 30 results in Table 1 consistent and predictable? Or are there special causes present? If there are special causes present, then you don’t really know that the average is 1.106.

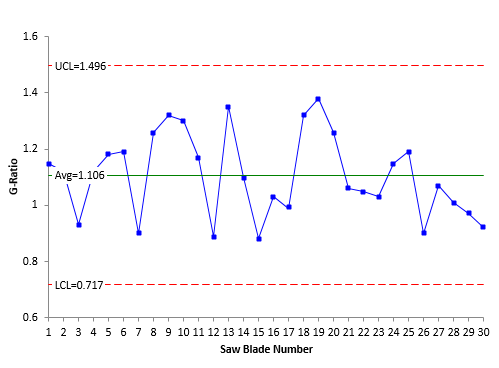

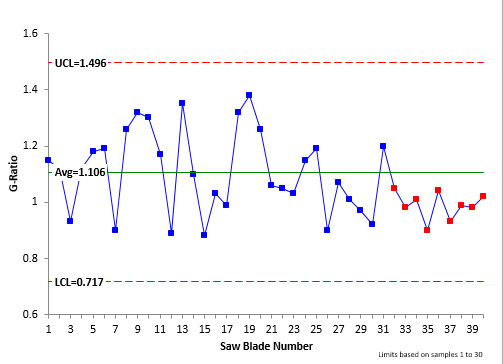

Only one way to check this and that is to use control charts. The individual control chart for the baseline G-ratio for Supplier A is shown in Figure 1. We will not show the moving range chart here.

Figure 1: X Chart for G-Ratio for Supplier A

The control chart in Figure 1 is in statistical control – the process for Supplier A appears to be consistent and predictable. Over time, the G-ratios will vary from about 0.72 to 1.5 with an average of 1.1.

Now you have your Supplier A baseline data. The average and the control limits based on the baseline data are used to judge if the saw blades from Supplier B have a significant impact on the G-ratio.

Supplier B G-Ratio Data

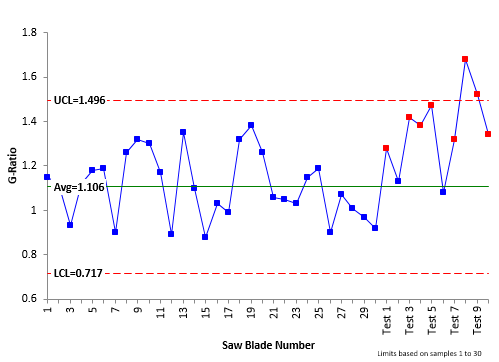

Supplier B has given you ten blades to test out. The ten blades are run in production and the operators collect the G-ratio data. The data are shown in Table 2. The data in Table 2 are added to the control chart as shown in Figure 2.

Table 2: Saw Blade G-Ratio for Supplier B

| Saw Blade No. | G-Ratio | Saw Blade No. | G-Ratio | |

| Test 1 | 1.28 | Test 6 | 1.08 | |

| Test 2 | 1.13 | Test 7 | 1.32 | |

| Test 3 | 1.42 | Test 8 | 1.68 | |

| Test 4 | 1.38 | Test 9 | 1.52 | |

| Test 5 | 1.47 | Test 10 | 1.34 |

Figure 2: X Chart: G-Ratio with Test Blades Added

Remember that the average and control limits are based on the baseline data from Supplier A. You can see from Figure 3 that there are out of control points with the test saw blades from Supplier B. The points in red are out of control. The out of control conditions include one point beyond the control limit as well as Zone B test (4 out of 5 consecutive points in Zone B or beyond) and Zone A test (2 out of 3 consecutive points in Zone A or beyond). Please see our publication on interpreting control charts for more information on out of control tests.

The G-ratios for the test saw blades from Supplier B appear to be in statistical control. There are no out of control points for the test saw blades. The average G-ratio for the test saw blades is 1.362. This compares to 1.106 for the current saw blades from Supplier A.

Supplier B definitely has a higher G-ratio than Supplier A. So, do you switch to Supplier B with the test saw blades? No, not quite yet. You need to look at the financial impact of switching.

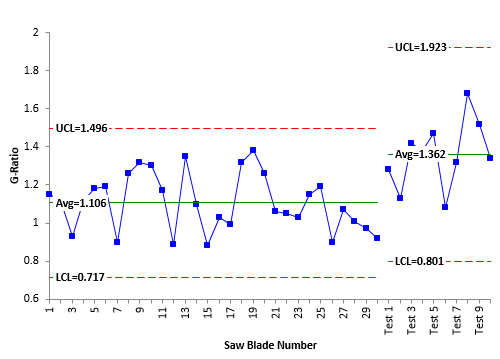

Figure 3: X Chart with Split Control Limits

Comparing the Cost of Supplier A to Supplier B

It should be noted that changing the saw blades more frequently with Supplier A does create more downtime. The downtime costs could be added to the financial analysis. But based solely on the cost of the saw blade and the G-ratio, it makes more sense to stay with the current saw blades from Supplier A.

Continued Monitoring

Saw blade life is an example of a real cost to an organization. The more saw blades you use, the more the cost. It makes sense to track performance of metrics like this over time. For example, suppose you continued to track the G-ratio over time for Supplier A. After time, the control chart looks like the one in Figure 4.

Figure 4: Control Chart for Supplier A Saw Blades

You can see what happened. The G-ratio has now decreased. Something with the supplier’s process has changed – and it is decreasing the cuts you get from each saw blade and increasing your costs. Time to talk to Supplier A.

Summary

Then test the second supplier’s material. Use the control chart to search for differences between the suppliers. If the second supplier is significantly different, it will show up as out of control points on the control chart.

In addition to performance, you need to consider the overall cost to the organization of both suppliers.

Shouldn't we also be concerned that Supplier B's G-ratios have a wider range than Supplier A? Isn't it likely that their manufacturing process is less capable?

Yes, you are correct. There is more variation in Supplier B than Supplier A. It is likely that their process is less capable and that should be included in supplier decisions. Another reason to stay with Supplier A. Thanks for the comment.